Regional Construction Hotspots in Great Britain

A forward-looking analysis of construction activity by region and by sector.

Overview

But by using ONS regional economic data, it becomes clear that despite their overall dominance, only three of the top ten largest local authority areas for construction activity in 2023 were in London and the South East: Westminster, West Surrey and Berkshire. However, it is Hertfordshire, in the East of England, that remained as the sub-region with the largest value of construction activity in 2023. Sub-regions in the South West, the East of England, the West Midlands, Yorkshire and the Humber, and East Midlands complete the top ten list, underscoring the fact that there are large areas of activity beyond the traditional engines of growth.

This annual regional report analyses construction contract awards at a high level of regional granularity, firstly to identify pockets of growth or contraction – hotspots and coldspots – in regional activity and secondly, to offer a forward-looking indication of growth by region and by sector. One of the challenges in using such granular data is the large lags in reporting of official output data, as evidenced by the most recent macroeconomic data published by the ONS being for 2023. By using data on contract awards in 2024, this aims to highlight construction work ahead, rather than reporting on activity is past periods that may not be relevant.

It also showcases the breadth of variation from a single Great Britain-wide figure of construction performance or contract awards activity. Overall in 2024, total GB contract awards rose 13.1%, but with growth rates ranging between +1946% and -95% when analysing at a considerably more granular regional level, stark differences in regional and sector performance become apparent.

It is important to note that the economic backdrop will be a major driver and influence on contract awards – from delays in tendering due to cost rises or project adjustments, hesitancy to proceed when financing costs have increased, to large projects initially approved in 2020, 2021 and 2022 now reaching go-ahead and contract award. The value of contract awards in 2024 is still likely to reflect high rates of construction price inflation and even some re-tendered contracts to reflect renegotiated or repricing. Given that the long-running buzzword of ‘uncertainty’ is still high on risk registers, the lags between contract award and start date may also be lengthened, as well as the lingering possibility of projects stalling or being cancelled after contract award.

Share your work email for FREE access to our Regional Construction Hotspots report

Construction GVA in 2023

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Location | £ million |

|---|---|---|---|---|---|---|

| 1 | ellierourke | 08/09/2025 09:20 AM | ellierourke | 08/09/2025 09:20 AM | South East | 23,963 |

| 2 | ellierourke | 08/09/2025 09:20 AM | ellierourke | 08/09/2025 09:20 AM | London | 22,573 |

| 3 | ellierourke | 08/09/2025 09:20 AM | ellierourke | 08/09/2025 09:20 AM | East of England | 19,324 |

| 4 | ellierourke | 08/09/2025 09:20 AM | ellierourke | 08/09/2025 09:20 AM | North West | 15,769 |

| 5 | ellierourke | 08/09/2025 09:20 AM | ellierourke | 08/09/2025 09:20 AM | South West | 12,468 |

| 6 | ellierourke | 08/09/2025 09:20 AM | ellierourke | 08/09/2025 09:20 AM | West Midands | 11,744 |

| 7 | ellierourke | 08/09/2025 09:20 AM | ellierourke | 08/09/2025 09:20 AM | Yorkshire and the Humber | 11,387 |

| 8 | ellierourke | 08/09/2025 09:20 AM | ellierourke | 08/09/2025 09:20 AM | East Midlands | 11,043 |

| 9 | ellierourke | 08/09/2025 09:20 AM | ellierourke | 08/09/2025 09:20 AM | Scotland | 11,017 |

| 10 | ellierourke | 08/09/2025 09:20 AM | ellierourke | 08/09/2025 09:20 AM | Wales | 5,180 |

| 11 | ellierourke | 08/09/2025 09:20 AM | ellierourke | 08/09/2025 09:20 AM | North East | 4,967 |

Construction GVA in 2023 - Top 10

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Location | £ million | Region |

|---|---|---|---|---|---|---|---|

| 1 | ellierourke | 08/09/2025 09:24 AM | ellierourke | 08/09/2025 09:24 AM | Hertfordshire | 4,463 | East of England |

| 2 | ellierourke | 08/09/2025 09:24 AM | ellierourke | 08/09/2025 09:24 AM | Westminster | 3,712 | London |

| 3 | ellierourke | 08/09/2025 09:24 AM | ellierourke | 08/09/2025 09:24 AM | West Surrey | 2,786 | South East |

| 4 | ellierourke | 08/09/2025 09:24 AM | ellierourke | 08/09/2025 09:24 AM | Berkshire | 2,602 | South East |

| 5 | ellierourke | 08/09/2025 09:24 AM | ellierourke | 08/09/2025 09:24 AM | Leicestershire CC and Rutland | 2,372 | East Midlands |

| 6 | ellierourke | 08/09/2025 09:24 AM | ellierourke | 08/09/2025 09:24 AM | Leeds | 2,307 | Yorkshire and the Humber |

| 7 | ellierourke | 08/09/2025 09:24 AM | ellierourke | 08/09/2025 09:24 AM | Birmingham | 2,129 | West Midlands |

| 8 | ellierourke | 08/09/2025 09:24 AM | ellierourke | 08/09/2025 09:24 AM | Devon CC | 2,109 | South West |

| 9 | ellierourke | 08/09/2025 09:24 AM | ellierourke | 08/09/2025 09:24 AM | Heart of Essex | 2,004 | East of England |

| 10 | ellierourke | 08/09/2025 09:24 AM | ellierourke | 08/09/2025 09:24 AM | Staffordshire CC | 1,993 | West Midlands |

What is a hotspot or a coldspot?

Hotspots and coldspots seek to identify regions where contract awards in 2024 were significantly above or below previous years, highlighting pockets of activity or contraction in construction activity over the near-term horizon.

As discussed, some regions of the country host more construction activity than others. Westminster was in the top 10 largest regions in terms of the value of contracts awarded in 2024. However, the value of contracts awarded in Westminster was 25% lower than in the previous year, so whilst it will provide a large source of construction work, it is not hotspot regions.

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Location | £ million | Annual % change |

|---|---|---|---|---|---|---|---|

| 1 | ellierourke | 08/09/2025 09:26 AM | ellierourke | 08/09/2025 09:26 AM | North and West Norfolk | 3,827 | 1946% |

| 2 | ellierourke | 08/09/2025 09:26 AM | ellierourke | 08/09/2025 09:26 AM | Camden and City of London | 3,696 | 46% |

| 3 | ellierourke | 08/09/2025 09:26 AM | ellierourke | 08/09/2025 09:26 AM | Manchester | 2,653 | 100% |

| 4 | ellierourke | 08/09/2025 09:26 AM | ellierourke | 08/09/2025 09:26 AM | Hertfordshire | 1,917 | 158% |

| 5 | ellierourke | 08/09/2025 09:26 AM | ellierourke | 08/09/2025 09:26 AM | North Yorkshire CC | 1,908 | 277% |

| 6 | ellierourke | 08/09/2025 09:26 AM | ellierourke | 08/09/2025 09:26 AM | Clackmannanshire and Fife | 1,893 | 946% |

| 7 | ellierourke | 08/09/2025 09:26 AM | ellierourke | 08/09/2025 09:26 AM | Westminster | 1,791 | -25% |

| 8 | ellierourke | 08/09/2025 09:26 AM | ellierourke | 08/09/2025 09:26 AM | Kent Thames Gateway | 1,790 | 408% |

| 9 | ellierourke | 08/09/2025 09:26 AM | ellierourke | 08/09/2025 09:26 AM | Birmingham | 1,553 | 24% |

| 10 | ellierourke | 08/09/2025 09:26 AM | ellierourke | 08/09/2025 09:26 AM | Lewisham and Southwark | 1,526 | 48% |

Large growth rates or contractions themselves do not necessarily signify a hotspot or coldspot, which is a key consideration for regions hosting small volumes of construction work, where growth rates on annual basis can be volatile. This is highlighted by contract award values in the Western Isles, which increased more than ten-fold in 2024, but at £97 million, it was still one of the twenty smallest regions for contract awards in Great Britain. Similarly, contract award values in the region of Kingston-upon-Hull doubled in 2024, but this reflects a bounceback from a weak year for contract awards in 2023. Values were still lower than the long-term average. Hotspots and coldspots are also, therefore, relative to the size of each region. In a region that typically has a low volume or value of contract awards, one residential project could double annual contract award values and push the 2024 total above the long-term average – a hotspot. In contrast, one residential project in Camden and City of London is unlikely to significantly affect the growth rate or variance from the long-term average and produce a hotspot.

Growth in contract awards in 2024 - Top 10

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Location | Annual % change | £ million |

|---|---|---|---|---|---|---|---|

| 1 | ellierourke | 08/09/2025 09:51 AM | ellierourke | 08/09/2025 09:51 AM | North and West Norfolk | 1946% | 3,827 |

| 2 | ellierourke | 08/09/2025 09:51 AM | ellierourke | 08/09/2025 09:51 AM | Eilean Siar (Western Isles) | 1341% | 97 |

| 3 | ellierourke | 08/09/2025 09:51 AM | ellierourke | 08/09/2025 09:51 AM | Clackmannanshire and Fife | 946% | 1,893 |

| 4 | ellierourke | 08/09/2025 09:51 AM | ellierourke | 08/09/2025 09:51 AM | Thurrock | 762% | 762 |

| 5 | ellierourke | 08/09/2025 09:51 AM | ellierourke | 08/09/2025 09:51 AM | Brighton and Hove | 506% | 491 |

| 6 | ellierourke | 08/09/2025 09:51 AM | ellierourke | 08/09/2025 09:51 AM | Kent Thames Gateway | 408% | 1,790 |

| 7 | ellierourke | 08/09/2025 09:51 AM | ellierourke | 08/09/2025 09:51 AM | Dumfries & Galloway | 292% | 321 |

| 8 | ellierourke | 08/09/2025 09:51 AM | ellierourke | 08/09/2025 09:51 AM | Somerset | 284% | 1,161 |

| 9 | ellierourke | 08/09/2025 09:51 AM | ellierourke | 08/09/2025 09:51 AM | North Yorkshire CC | 277% | 1,908 |

| 10 | ellierourke | 08/09/2025 09:51 AM | ellierourke | 08/09/2025 09:51 AM | Essex Haven Gateway | 277% | 950 |

Falls in contract awards in 2024 - Top 10

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Location | Annual % change | £ million |

|---|---|---|---|---|---|---|---|

| 1 | ellierourke | 08/09/2025 09:55 AM | ellierourke | 08/09/2025 09:55 AM | Isle of Wight | -95% | 1 |

| 2 | ellierourke | 08/09/2025 09:55 AM | ellierourke | 08/09/2025 09:55 AM | Shetland Islands | -85% | 10 |

| 3 | ellierourke | 08/09/2025 09:55 AM | ellierourke | 08/09/2025 09:55 AM | Orkney Islands | -80% | 116 |

| 4 | ellierourke | 08/09/2025 09:55 AM | ellierourke | 08/09/2025 09:55 AM | Brent | -78% | 119 |

| 5 | ellierourke | 08/09/2025 09:55 AM | ellierourke | 08/09/2025 09:55 AM | North Lanarkshire | -77% | 192 |

| 6 | ellierourke | 08/09/2025 09:55 AM | ellierourke | 08/09/2025 09:55 AM | Cheshire West and Chester | -77% | 473 |

| 7 | ellierourke | 08/09/2025 09:55 AM | ellierourke | 08/09/2025 09:55 AM | Suffolk | -76% | 100 |

| 8 | ellierourke | 08/09/2025 09:55 AM | ellierourke | 08/09/2025 09:55 AM | Buckinghamshire CC | -73% | 130 |

| 9 | ellierourke | 08/09/2025 09:55 AM | ellierourke | 08/09/2025 09:55 AM | East Cumbria | -72% | 100 |

| 10 | ellierourke | 08/09/2025 09:55 AM | ellierourke | 08/09/2025 09:55 AM | Dorset CC | -68% | 231 |

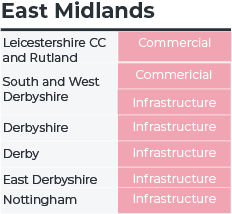

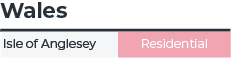

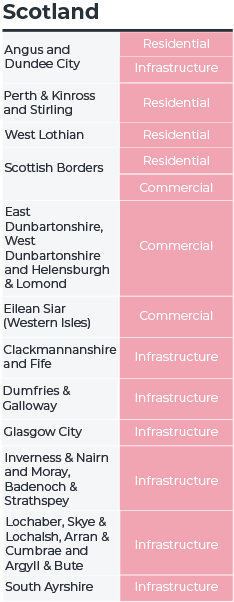

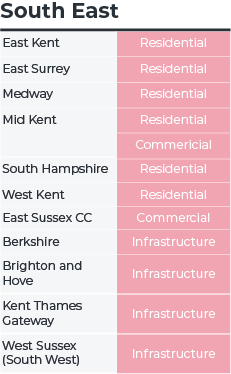

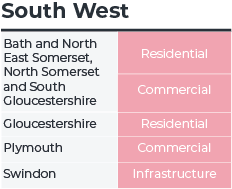

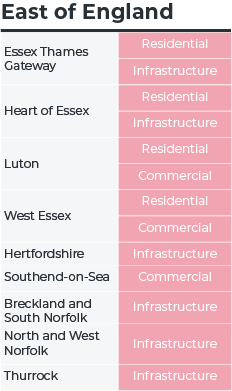

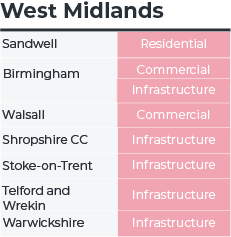

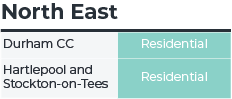

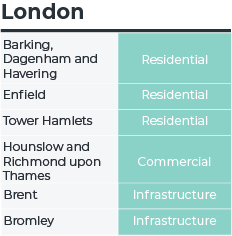

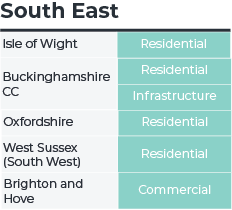

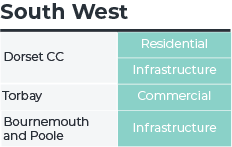

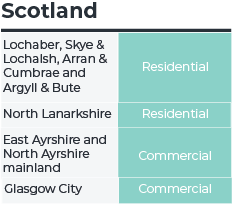

There are clear hotspots for upcoming construction activity over the next 6-24 months in Great Britain, with hotspots outnumbering coldspots by two-to-one overall and seven-to-one for infrastructure, which continues the trend of infrastructure driving hotspot activity seen in previous reports. There were equal numbers of residential hotspots and coldspots in 2024, which reflects weakness in the housing market and house building activity, which reached a nadir at the end of 2023 and early 2024, before interest rates started to be reduced by the Bank of England. Residential coldspots were most prevalent in regions with higher house prices – London, the East of England and the South East, likely indicating that demand in these regions was most affected by the affordability of higher mortgage repayments.

There were no broad hotspots in 2024 – where contract awards in each of the three main construction sectors of residential, commercial and infrastructure, were significantly above the long-term average. In this year’s report, single-sector hotspots in residential, commercial or infrastructure were most common, although there were several reporting hotspots in two sectors of construction. Encouragingly, regions with single or double hotspots were spread across Great Britain. Moreover, hotspots outnumbered coldspots in all regions of Great Britain except Wales and the most hotspots were registered in Scotland, the East of England, and the South East.

Given the varying nature in the size of construction projects, construction hotspots may also show due to a single large project in one sector (see table below). Although these may be viewed as skewing results, they still represent a significant driver of regional growth and activity and were a key driver of hotspots throughout the country. These tend to be high-value transport or utilities projects in the infrastructure sector where contracts are awarded, but take time to build out – such as the Hornsea Project Three offshore wind farm, the Lower Thames Crossing and two projects for the Eastern Green Link 2. There was also a broader spread of construction sectors in the top ten in this year’s report – the Google data centre in Waltham Cross, the former ITV studios redevelopment into offices on the South Bank in London, as well as the Agratas gigafactory in Somerset.

In smaller sub-regions, single, large offices, retail and residential projects can also generate hotspots: two residential retirement complexes totalling over £100 million in West Malling and Tunbridge Wells underpinned West Kent’s hotspot status, for example.

Construction coldspots featured only lightly across Great Britain. The fewest were registered in the West Midlands (one), the North East, Yorkshire and the Humber, the East Midlands and Wales (two each).

Top 10 Highest Value Contracts in 2024

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Project | Value | Area |

|---|---|---|---|---|---|---|---|

| 1 | ellierourke | 08/09/2025 10:00 AM | ellierourke | 08/09/2025 10:00 AM | Hornsea Project Three Offshore Wind Farm | £3.6 billion | North and West Norfolk |

| 2 | ellierourke | 08/09/2025 10:00 AM | ellierourke | 08/09/2025 10:00 AM | Inch Cape 1080 MW Offshore Wind Farm | £1.5 billion | Clackmannanshire and Fife |

| 3 | ellierourke | 08/09/2025 10:00 AM | ellierourke | 08/09/2025 10:00 AM | Lower Thames Tunnel Crossing - Tunnelling | £1.3 billion | Kent Thames Gateway |

| 4 | ellierourke | 08/09/2025 10:00 AM | ellierourke | 08/09/2025 10:00 AM | Google Data Centre - Waltham Cross Cheshunt | £800 million | Hertfordshire |

| 5 | ellierourke | 08/09/2025 10:00 AM | ellierourke | 08/09/2025 10:00 AM | East Birmingham To Solihull Extension | £735 million | Birmingham |

| 6 | ellierourke | 08/09/2025 10:00 AM | ellierourke | 08/09/2025 10:00 AM | Eastern Green Link 2 - Converter Station | £700 million | North Yorkshire CC |

| 7 | ellierourke | 08/09/2025 10:00 AM | ellierourke | 08/09/2025 10:00 AM | Thurrock Flexible Generation Plant - 750MW | £645 million | Thurrock |

| 8 | ellierourke | 08/09/2025 10:00 AM | ellierourke | 08/09/2025 10:00 AM | ITV Studios Redevelopment | £500 million | Lambeth |

| 9 | ellierourke | 08/09/2025 10:00 AM | ellierourke | 08/09/2025 10:00 AM | Eastern Green Link 2 - HVDC Underground | £500 million | North Yorkshire CC |

| 10 | ellierourke | 08/09/2025 10:00 AM | ellierourke | 08/09/2025 10:00 AM | Agratas Gigafactory - Building One | £500 million | Somerset |

Hotspots

Coldspots

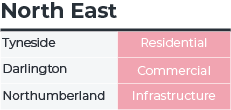

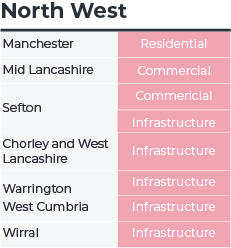

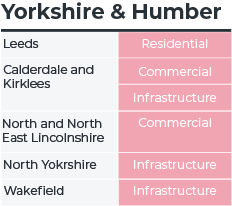

Case Study: Revisiting the Northern Powerhouse

The Northern Powerhouse was a key policy area for the Conservative-Liberal Democrat coalition government between 2010 and 2015, and was continued under the Conservative government after the 2015 General Election. Its aim was to rebalance and boost economic growth in the North of England, primarily through investment in infrastructure, science and innovation and an element of devolution through City Deals and elected regional mayors. The term has now largely disappeared from government vernacular, replaced over time with general ‘Levelling Up’ and regional investment deals and devolution.

The Northern Powerhouse featured as the case study in the 2019 edition of this report as initial projects started to be awarded contracts, but over ten years after it became an area of focus for government policy and regional investment, this edition looks at how construction activity and construction contract awards have evolved over that decade across the regions of the North East, the North West, Yorkshire and the Humber and North Wales. The data has also been broken down to cover what were labelled the “core cities” of Kingston-upon-Hull, Manchester, Liverpool, Leeds, Sheffield and Newcastle.

Annual average growth 2015-2024

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Location | GDP | Construction GVA | Contract awards |

|---|---|---|---|---|---|---|---|---|

| 1 | ellierourke | 12/09/2025 01:20 PM | ellierourke | 12/09/2025 01:20 PM | UK | 1.50% | 5.70% | 3.70% |

| 2 | ellierourke | 12/09/2025 01:20 PM | ellierourke | 12/09/2025 01:20 PM | North East | 1.30% | 7.50% | 1.60% |

| 3 | ellierourke | 12/09/2025 01:20 PM | ellierourke | 12/09/2025 01:20 PM | North West | 1.90% | 7.10% | 2.80% |

| 4 | ellierourke | 12/09/2025 01:20 PM | ellierourke | 12/09/2025 01:20 PM | Yorkshire and the Humber | 1.60% | 7.30% | 6.20% |

| 5 | ellierourke | 12/09/2025 01:20 PM | ellierourke | 12/09/2025 01:20 PM | North Wales | 1.40% | 7.40% | 13.90% |

| 6 | ellierourke | 12/09/2025 01:20 PM | ellierourke | 12/09/2025 01:20 PM | Kingston-upon-Hull | 1.30% | 6.80% | 204.20% |

| 7 | ellierourke | 12/09/2025 01:20 PM | ellierourke | 12/09/2025 01:20 PM | Manchester | 4.80% | 12.00% | 19.30% |

| 8 | ellierourke | 12/09/2025 01:20 PM | ellierourke | 12/09/2025 01:20 PM | Liverpool | 2.10% | 7.30% | 1.90% |

| 9 | ellierourke | 12/09/2025 01:20 PM | ellierourke | 12/09/2025 01:20 PM | Leeds | 2.60% | 8.10% | 32.90% |

| 10 | ellierourke | 12/09/2025 01:20 PM | ellierourke | 12/09/2025 01:20 PM | Sheffield | 1.80% | 6.80% | -5.70% |

| 11 | ellierourke | 12/09/2025 01:20 PM | ellierourke | 12/09/2025 01:20 PM | Newcastle | 2.20% | 8.40% | 0.70% |

In terms of economic growth, average annual real GDP growth has outpaced UK-level GDP growth for the majority of Northern Powerhouse regions and cities; the North East, North Wales and Kingston-upon-Hull are the exceptions. Construction GVA growth over the period displayed a stronger average annual growth rate than the UK average in all regions and cities. Of course, context is everything and this report cannot determine if stronger growth rates in the Northern Powerhouse regions can be solely attributed to an increased government policy focus.

Average annual growth in contract awards was more varied, with a broad split between regions and cities where growth was above the UK outturn – Yorkshire and the Humber, North Wales, Kingston-upon-Hull, Leeds and Manchester and those where it was below – the North East, the North West, Liverpool, Newcastle and Sheffield.

Over the last ten years, some of the country’s largest contract awards have been for projects in the Northern Powerhouse regions: the £2.3 billion Transpennine Route Upgrade in 2017, the £1.5 billion Sellafield Product and Residue Store Retreatment Plant (SRP) and the £1.5 billion Dogger Bank Creyke Beck offshore wind farm in 2020. All three are currently underway. Others have already completed such as the Tees Renewable Energy Plant and Everton FC’s new stadium, which will have contributed significantly to regional construction activity.

Nevertheless, as is typical with large construction projects, final decision-making, contract award and project start are often subject to long lags for both publicly and privately funded schemes. Changes in the macroeconomic environment, construction costs and changes in investor and government priorities can all influence the speed at which projects proceed. Two privately-financed projects in the top 30 largest contract awards over the last decade remain either at the planning stage – the Able Marine Energy Park in the Humber Estuary – or subject to a final investment decision – the Wilton International lithium hydroxide manufacturing plant in Teesside, whilst the Wylfa nuclear power station, which would have been the second new nuclear power station after Hinkley Point C, was cancelled by its main investor in 2020, four years after contract award.

A similar fate has also hit two of the major roads projects that were among the region’s largest contract awards. The M62 upgrade between junctions 20 and 25 was cancelled as part of the government’s scrapping of smart motorways in 2023, whilst the A5036 Port of Liverpool access improvements scheme was paused in 2023 and pushed back into National Highways’ RIS3 road investment period, before being officially cancelled in the Budget in October 2024 as the Treasury labelled it unfunded and affordable.

Top 30 Largest Contract Awards in the Northern Powerhouse

| wdt_ID | wdt_created_by | wdt_created_at | wdt_last_edited_by | wdt_last_edited_at | Project | Region | Sector | Year awarded | Value | Status |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Transpennine Route Upgrade - West Of Leeds | Yorkshire & the Humber | Infrastructure | 2017 | £2.3 billion | Underway |

| 2 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Dogger Bank Creyke Beck 1.4GW Offshore Wind Farm | Yorkshire & the Humber | Infrastructure | 2020 | £2.0 billion | Underway |

| 3 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Sellafield Retreatment Construction Programme | North West | Infrastructure | 2019 | £1.5 billion | Underway |

| 4 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Eastern Green Link 2 - Converter Station | Yorkshire & the Humber | Infrastructure | 2024 | £700 million | Early works |

| 5 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Tees Renewable 295MW Energy Plant | North East | Infrastructure | 2016 | £650 million | Complete |

| 6 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Sellafield - Clean-Up Decommissioning Programme | North West | Infrastructure | 2016 | £500 million | Underway |

| 7 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | WI Lithium Hydroxide Manufacturing Plant | North East | Industrial | 2022 | £500 million | Final investment decision pending |

| 8 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Everton FC Stadium | North West | Commercial | 2022 | £500 million | Complete |

| 9 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Eastern Green Link 2 - HVDC Underground Cables | Yorkshire & the Humber | Infrastructure | 2024 | £500 million | Underway |

| 10 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Lostock Energy From Waste Facility (69.9MW) | North West | Infrastructure | 2021 | £480 million | Nearing completion |

| 11 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Wylfa Nuclear Power Station - Anglesey | North Wales | Infrastructure | 2016 | £450 million | Cancelled |

| 12 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Manchester Airport T2 Transformation Project | North West | Infrastructure | 2016 | £450 million | Nearing completion |

| 13 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | HMP Millsike | Yorkshire & the Humber | Public Non-housing | 2022 | £400 million | Complete |

| 14 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | M62 Junctions 20-25 Smart Motorway | Yorkshire & the Humber | Infrastructure | 2020 | £392 million | Cancelled |

| 15 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | A1 Birtley To Coal House - Widening | North East | Infrastructure | 2021 | £370 million | Underway |

| 16 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | A63 Castle Street Improvements | Yorkshire & the Humber | Infrastructure | 2020 | £355 million | Underway |

| 17 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Metrolink Scheme - Trafford Park | North west | Infrastructure | 2017 | £350 million | Complete |

| 18 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Keadby 2 - 840MW CCGT Power Station | Yorkshire & the Humber | Infrastructure | 2018 | £350 million | Complete |

| 19 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Co-Op Live Manchester Arena | North West | Commercial | 2021 | £350 million | Complete |

| 20 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Etihad Stadium - North Stand Extension | North West | Commercial | 2024 | £340 million | Underway |

| 21 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | A5036 Port Of Liverpool Access Improvements | North West | Infrastructure | 2022 | £335 million | Cancelled |

| 22 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Manchester Town Hall Redevelopment | North West | Commercial | 2019 | £330 million | Underway |

| 23 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | New Town Victoria North - 1551 Apartments | North West | Residential | 2024 | £330 milliomn | Underway |

| 24 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Thirlmere-West Cumbria Link Water Mains Project | North West | Infrastructure | 2017 | £300 million | Complete |

| 25 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Blyth Offshore Wind Farm Demo Project - 41.5MW | North East | Infrastructure | 2017 | £300 million | Complete |

| 26 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Viadux Phase 1 | North West | Residential | 2020 | £300 million | Complete |

| 27 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Monopile Manufacturing Facility & UK HQ | North East | Industrial | 2022 | £300 million | Complete |

| 28 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Able Marine Energy Park - Main Quay Works | North East | Infrastructure | 2021 | £285 million | Planning |

| 29 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Ferrybridge Multifuel 2 (MF2) Power Station | Yorkshire & the Humber | Infrastructure | 2016 | £258 million | Complete |

| 30 | ellierourke | 12/09/2025 01:25 PM | ellierourke | 12/09/2025 01:25 PM | Burbo Bank Offshore Windfarm Extension | North West | Infrastructure | 2015 | £250 million | Complete |

Methodology

The ONS releases construction output data for Great Britain on a monthly and quarterly basis, and a regional breakdown of construction activity is reported three months following the end of the reference quarter. This regional data is only available on a non-seasonally adjusted basis and in current prices, making analysis more difficult than for national output data, which is available in constant price terms to indicate volumes of work.

Given the lags in reporting actual volumes of construction work completed, and the difficulties in measuring activity on a regional basis, this research seeks to identify regional ‘hotspots’ – where the value of construction contracts awarded in 2024 is above its historical average. This forward-looking approach aims to signpost areas of strength for construction over the next 12 months.

The analysis in this publication compares the value of construction contracts awarded in 2024 with the average (median) value of contract awards over the last four years across the residential, commercial and infrastructure sectors. If 2024 contract values are significantly above the long-term average, then this is considered a hotspot. Conversely, a region is considered a coldspot if 2024 contract values are significantly below the long-term average.

The hotspots are calculated using Barbour ABI data on contract awards, based on actual contract values, which have not been adjusted for inflation or deflation. The measure of heat indicates how the value of contracts awarded in 2018 compares with the long-term annual average, on a scale of –5 to +5: -5 being ‘very cold’, or significantly below the long-term average; +5 being ‘very hot’, or significantly above the long-term average.

Regional breakdown:

Regions in Great Britain have been broken down based on the International Territorial Level (ITL) level 3 groupings. This is one level above local authority-level data and is the UK standard for the subdivision of countries for statistical purposes. It mirrors the Nomenclature of Territorial Units for Statistics (NUTS) that is used by the EU.

There are 174 ITL3 regions in the UK, although the regions in this report cover the 168 regions in Great Britain only, to match the geographical coverage of construction output data from the ONS.

Sector breakdown:

The analysis is broken down to show contract awards in the three largest construction sectors: residential, commercial, and infrastructure.

Residential: housing (private developments), student accommodation, new build, conversions and change of use

Commercial: offices, retail, supermarkets, data centres

Infrastructure: railways and stations, roads, bridges, ports, harbours and waterways, energy and utilities