Sector Review

See the hottest sectors in your region, and the hottest regions in your sector.

Regional Spotlight

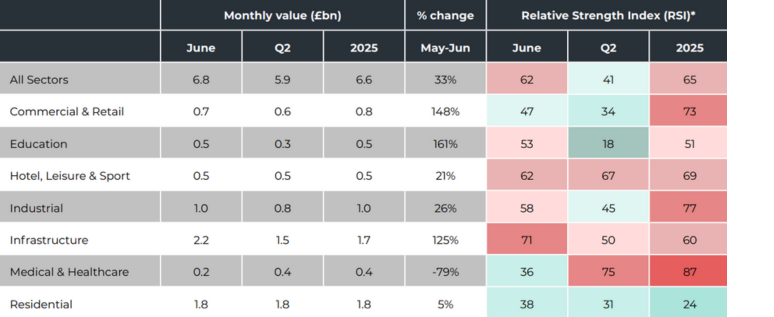

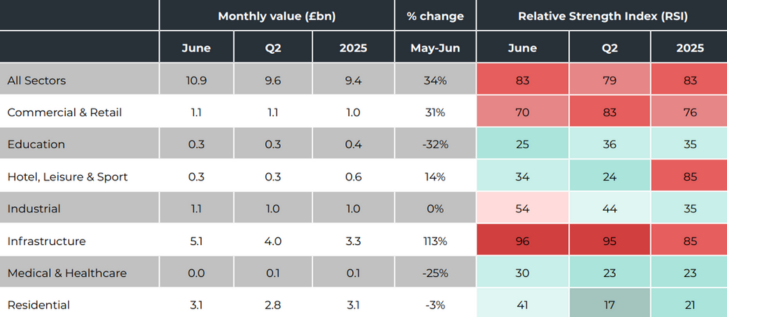

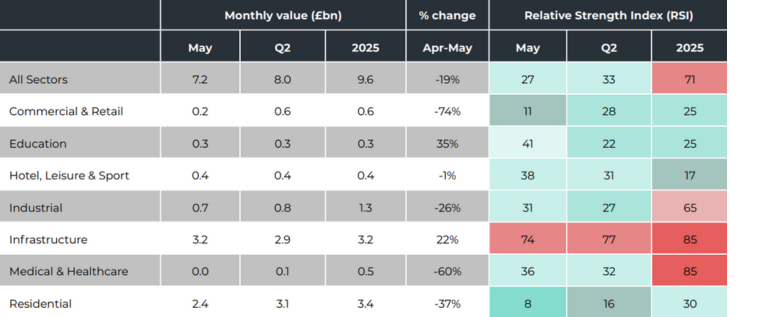

Construction Activity

Your essential guide for marketing to the construction industry.