The UK Residential Doors Market Research Report 2025–2029 provides a comprehensive analysis of current trends, market value, future forecasts and opportunities across all segments of the residential doors industry.

The report estimates the UK residential doors market to be worth £1.26 billion at MSP in 2024, equating to approximately 10.6 million units, despite economic turbulence and a subdued housing sector. Market performance has been shaped by a combination of Brexit, global conflict, and the ongoing cost-of-living crisis – all contributing to reduced disposable income and housing activity.

Growth in Value Despite Volume Declines

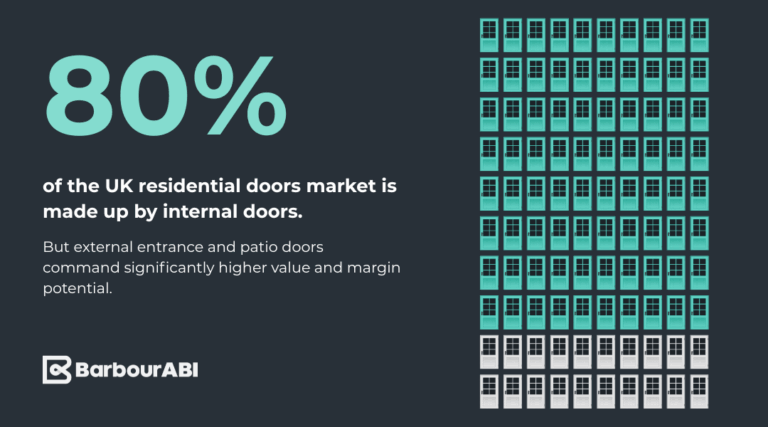

While door volumes fell by 10% in 2023 and plateaued in 2024, the market continues to benefit from a shift towards higher-value composite doors, driven by consumer demand for durability, energy efficiency, and security. Interior doors still account for over 80% of market volume, but external entrance and patio doors command significantly higher value and margin potential.

Material & Design Innovation

Timber remains the dominant material by volume, though uPVC and aluminium are gaining ground – especially in the replacement and premium patio door segments. The market has embraced aesthetic personalisation, with demand for larger glazed units, bold colours, and smart home integration on the rise. Smart locks, biometric entry, remote access, and energy-efficient glazing are now expected features in mid-to-high end doors.

Regulation-Driven Demand for Fire Doors

Post-Grenfell legislation is increasing the importance of fire doors in both new build and retrofit projects. The report values the fire door segment at £195 million in 2024, with further growth anticipated, particularly in multi-occupancy buildings and homes with loft conversions or three-storey layouts.

Market Outlook: Challenges and Opportunities

While residential RMI and new housing work have faced constraints, government targets to deliver up to 1.5 million new homes over the next five years represent a significant opportunity – if delivery can be achieved. The garage door market, tracked separately, is also seen as an adjacent growth area, given the high penetration of garages in UK homes and the trend towards multifunctional garage spaces.