Construction Industry Sector Review by Barbour ABI

A monthly review to showcase the industry’s top performing sectors by region to give you the latest insights into UK construction trends.

Formerly known as...

Previously available as a downloadable PDF, our Construction Industry Sector Review is now published directly on our website. This change makes the report easier to access, share, and revisit — no downloads or subscriptions required.

The Construction Industry Sector Review has one simple purpose: to enable you to see the hottest sectors in your region, and the hottest regions in your sector.

View the latest edition below⬇️

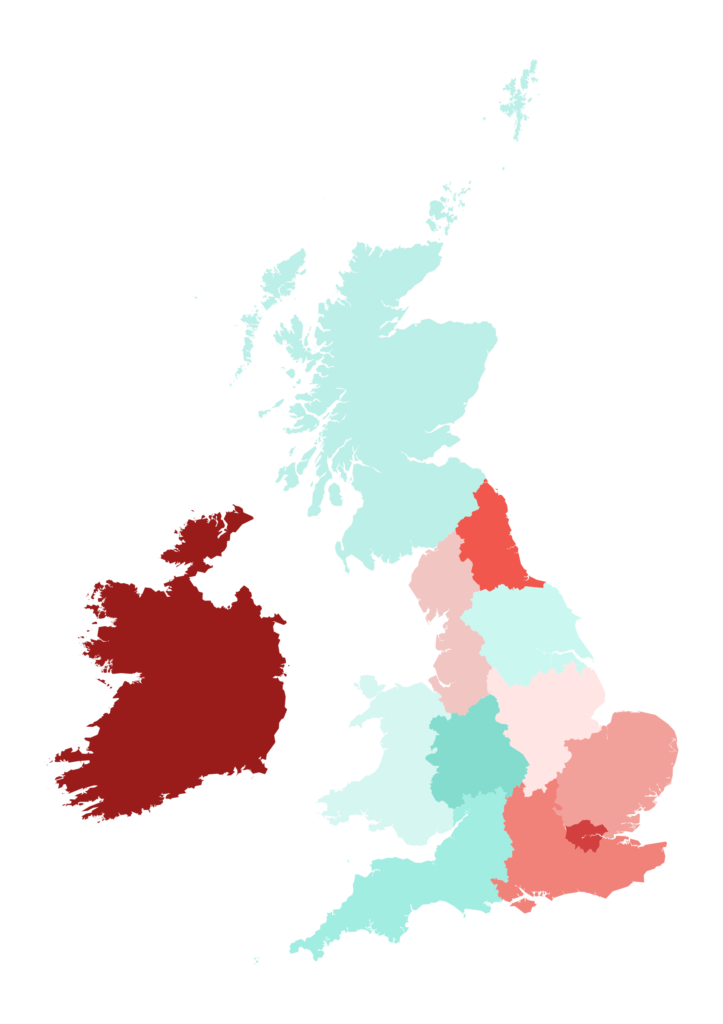

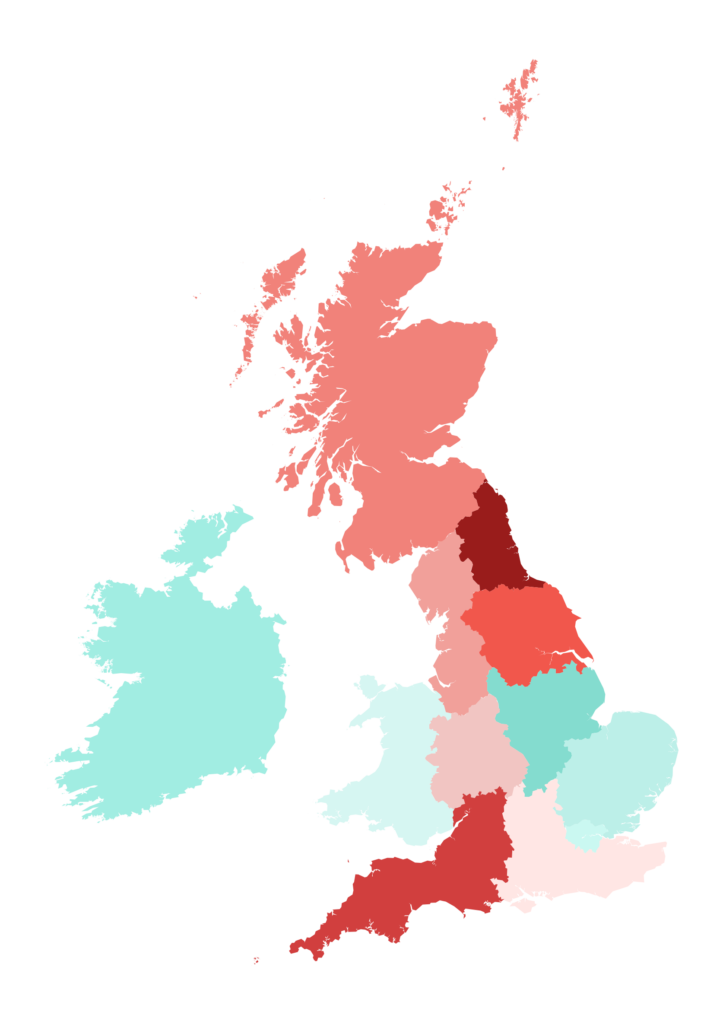

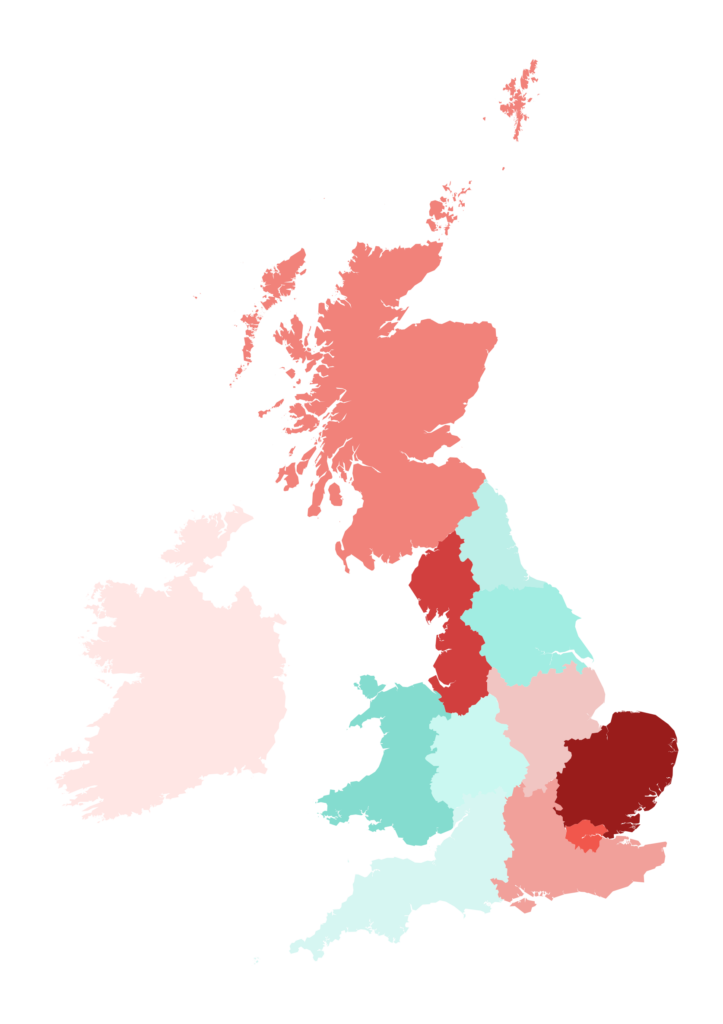

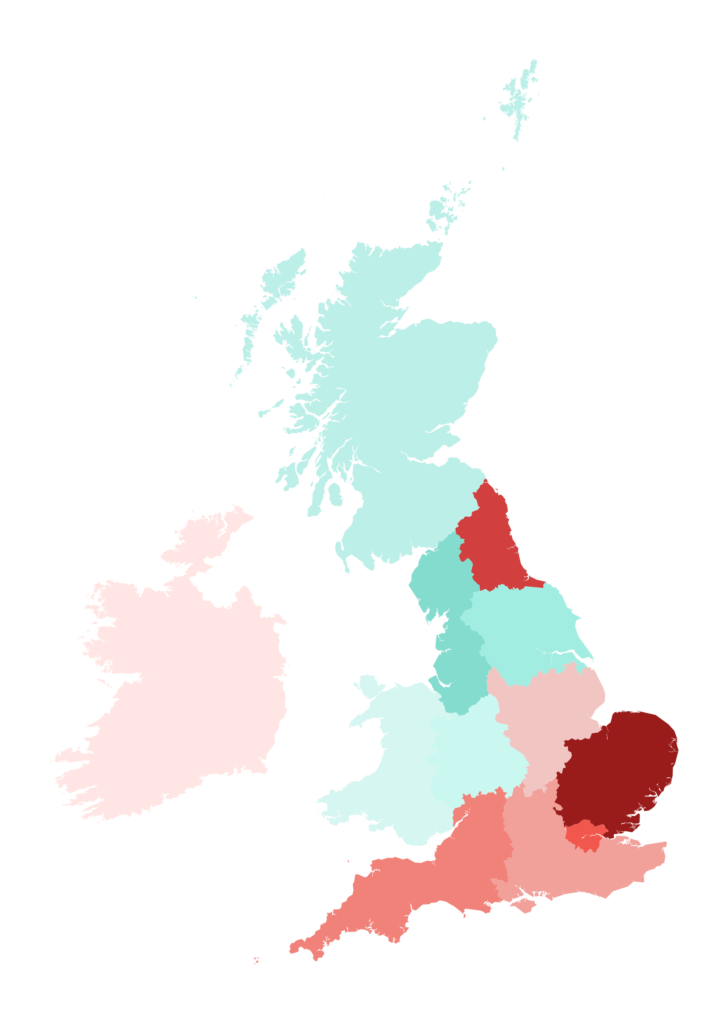

Residential

This consistently thriving sector has the potential for positive knock-on effects in other major sectors that you may be focusing upon. A large residential development may signal immediate commercial and retail opportunities, as well as future education and healthcare opportunities.

The Residential sector also features a more varied set of criteria than you might think. The largest numbers in the sector may usually come from private developments, housing associations, and apartment blocks, but retirement homes, hostels, halls of residence, and barracks all factor into the numbers for this huge sector. If you are targeting any of these subsectors, then this is where your business needs to focus on.

Contract award totals by region:

| Region | Value (£) |

|---|---|

| Republic of Ireland | 923,000,000 |

| London | 539,000,000 |

| North East | 247,000,000 |

| South East | 196,000,000 |

| East of England | 119,000,000 |

| North West | 113,000,000 |

| East Midlands | 89,000,000 |

| West Midlands | 67,000,000 |

| South West | 66,000,000 |

| Scotland | 57,000,000 |

| Yorks & Humber | 47,000,000 |

| Wales | 14,000,000 |

Planning approval totals by region:

| Region | Value (£) |

|---|---|

| Republic of Ireland | 823,000,000 |

| London | 754,000,000 |

| North West | 646,000,000 |

| West Midlands | 450,000,000 |

| South West | 440,000,000 |

| South East | 437,000,000 |

| North East | 299,000,000 |

| East of England | 292,000,000 |

| Yorks & Humber | 273,000,000 |

| East Midlands | 252,000,000 |

| Scotland | 179,000,000 |

| Northern Ireland | 152,000,000 |

| Wales | 62,000,000 |

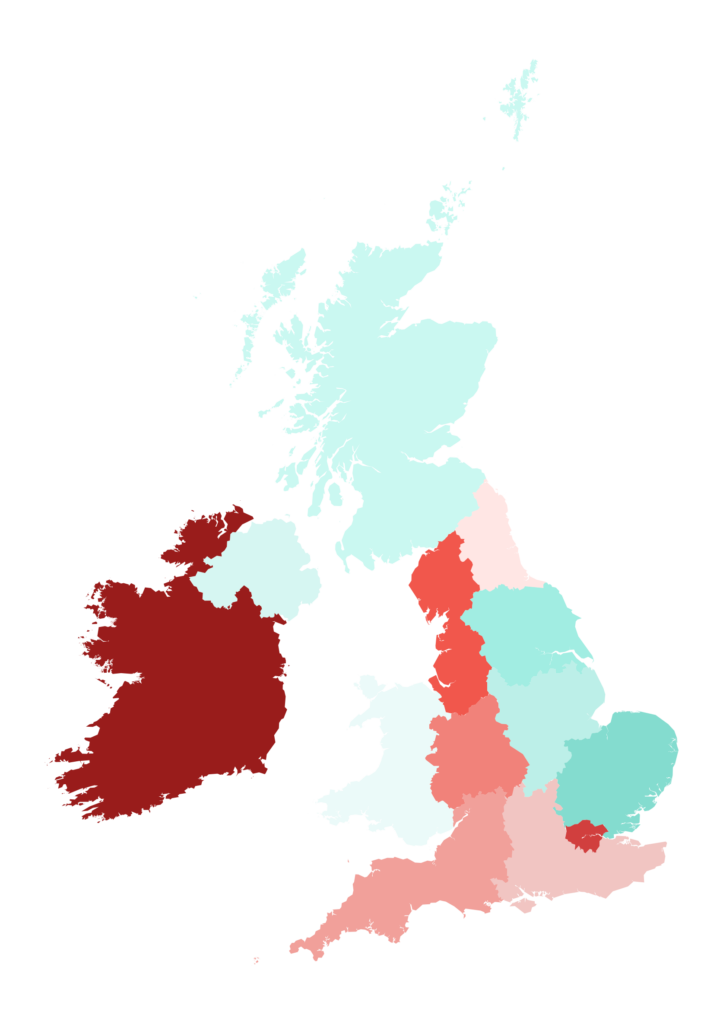

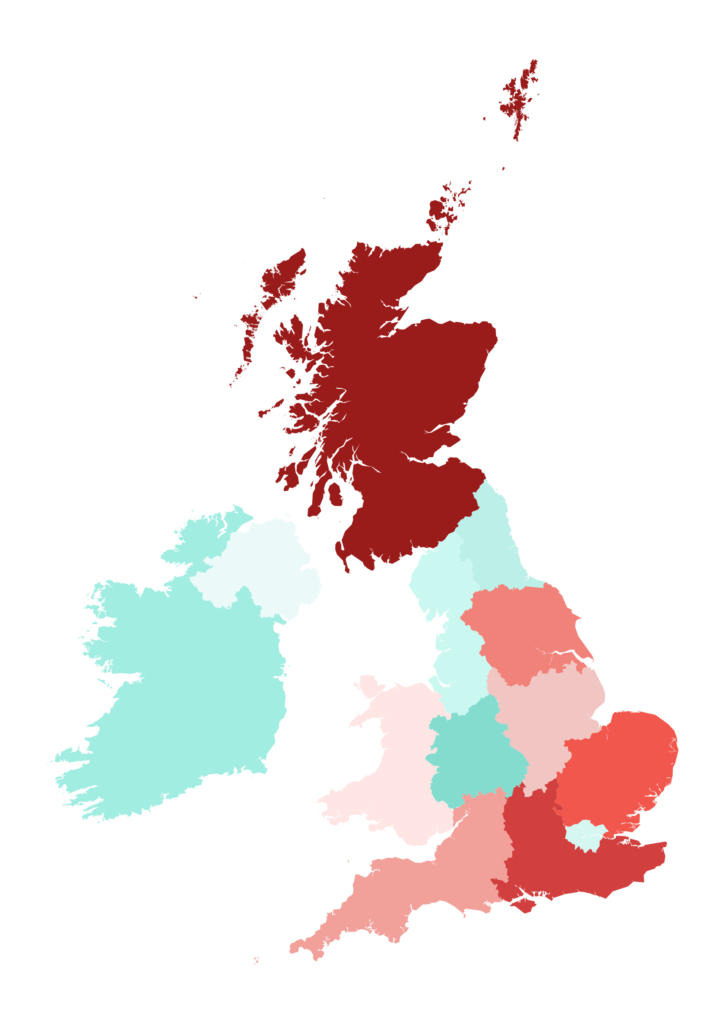

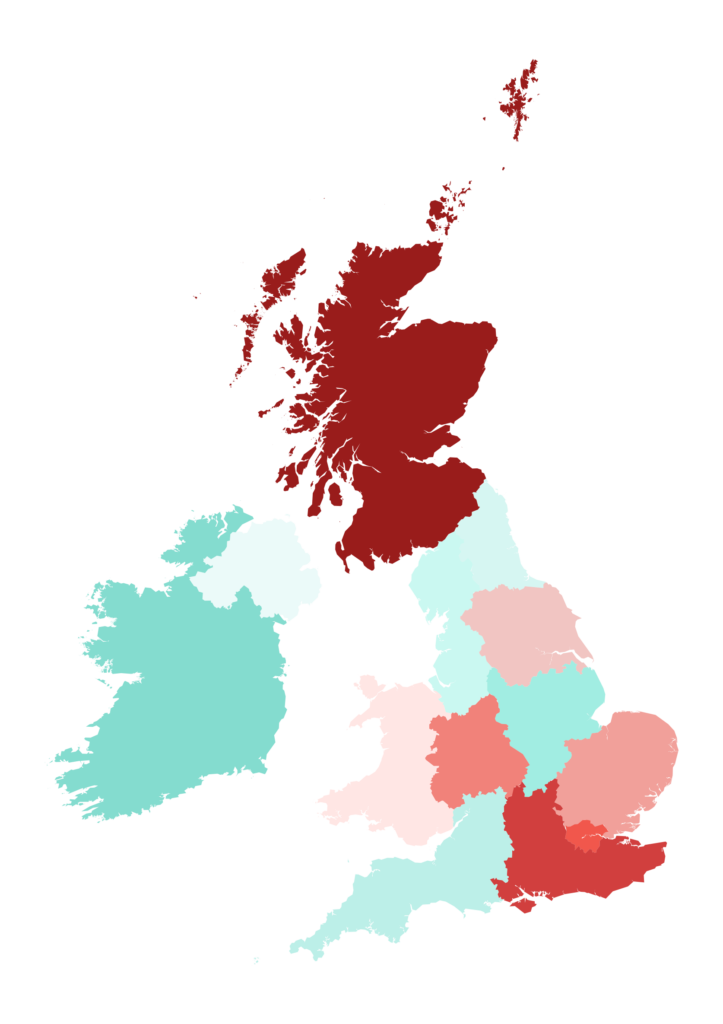

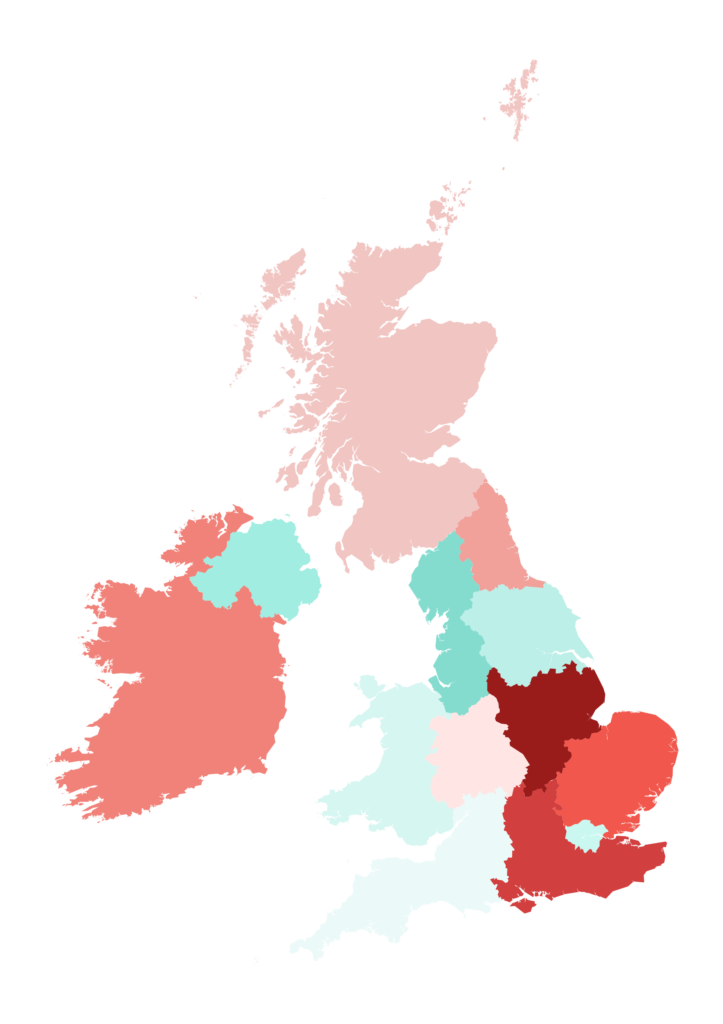

Commercial & Retail

The success of the Commercial & Retail sector can have major impacts on both the nation’s wider economy and other construction sectors, such as the Residential sector.

The dynamics at play in the huge office subsector have changed significantly in the past several years, with the traditional office space battling for supremacy with the growing shared workspace industry. Combining this trend with the ever-continuing changes to the High Street, this sector is a vital one to pay close attention to when considering your strategy for 2025 and beyond.

Contract award totals by region:

| Region | Value (£) |

|---|---|

| London | 515,000,000 |

| North East | 106,000,000 |

| East of England | 83,000,000 |

| Scotland | 53,000,000 |

| South East | 48,000,000 |

| North West | 36,000,000 |

| East Midlands | 22,000,000 |

| Wales | 19,000,000 |

| West Midlands | 15,000,000 |

| Republic of Ireland | 11,000,000 |

| South West | 10,000,000 |

| Yorks & Humber | 6,000,000 |

Planning approval totals by region:

| Region | Value (£) |

|---|---|

| London | 2,202,000,000 |

| Scotland | 123,000,000 |

| South East | 50,000,000 |

| East of England | 49,000,000 |

| Yorks & Humber | 37,000,000 |

| South West | 27,000,000 |

| North East | 26,000,000 |

| North West | 16,000,000 |

| East Midlands | 14,000,000 |

| West Midlands | 14,000,000 |

| Republic of Ireland | 11,000,000 |

| Northern Ireland | 7,000,000 |

| Wales | 6,000,000 |

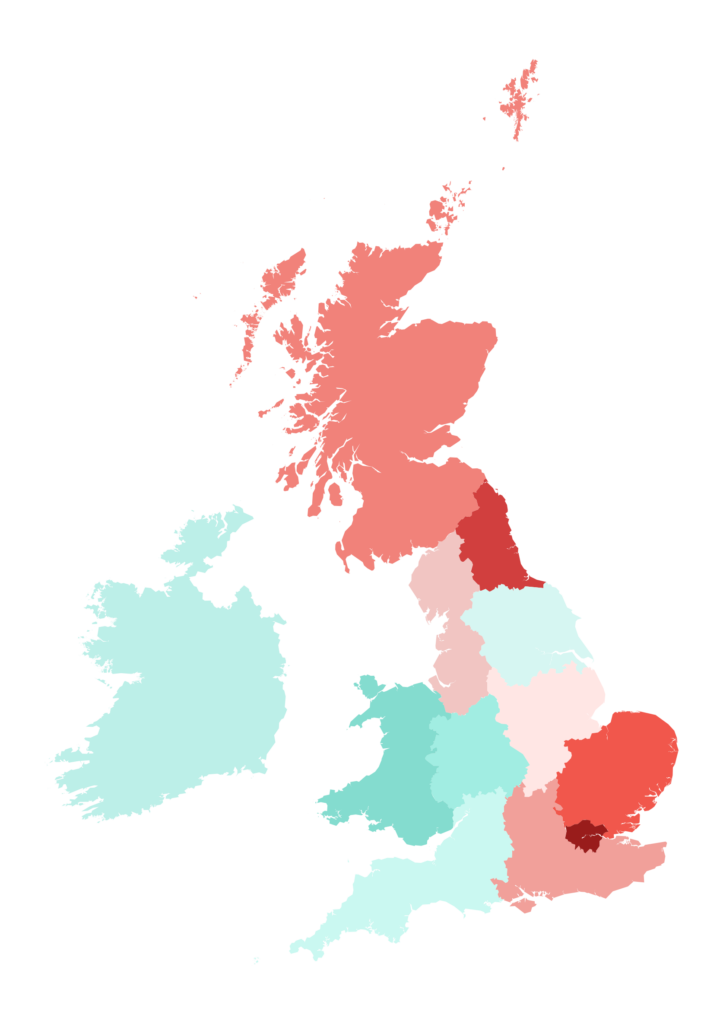

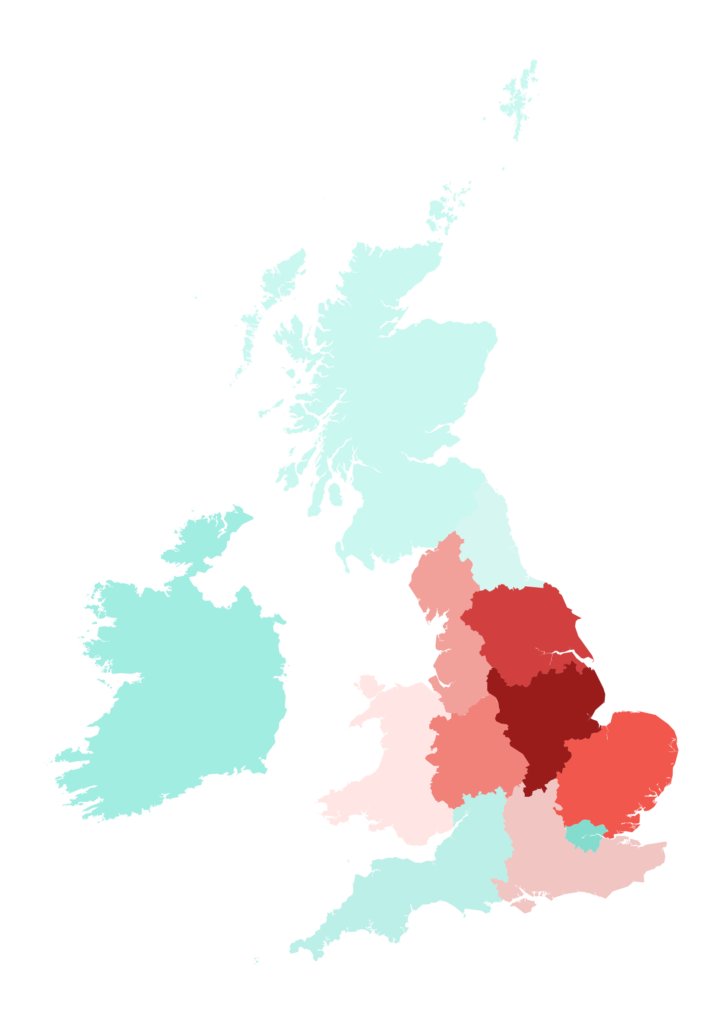

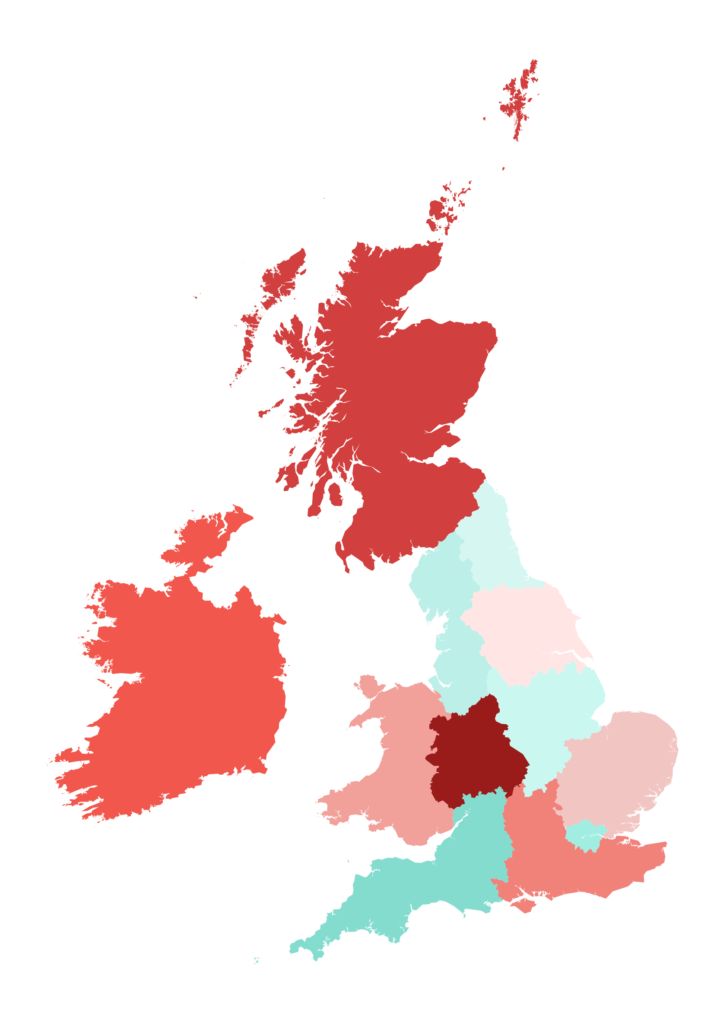

Infrastructure

This sector tends to be dominated by large-scale projects. It encompasses everything from motorway/road works, power facilities, utility plants, and rail improvements to station upgrades and new builds.

Major contractors tend to be key players in the Infrastructure sector. On the client side, government bodies, local councils, and large-scale utilities businesses will consistently be involved and will be looking for partners on their major projects. If any of these organisations are the types of business that you want to target, then this is the sector for you to focus on.

Contract award totals by region:

| Region | Value (£) |

|---|---|

| North East | 1,184,000,000 |

| South West | 329,000,000 |

| Yorks & Humber | 258,000,000 |

| Scotland | 243,000,000 |

| North West | 155,000,000 |

| West Midlands | 89,000,000 |

| South East | 64,000,000 |

| East Midlands | 45,000,000 |

| Republic of Ireland | 24,000,000 |

| East of England | 23,000,000 |

| London | 20,000,000 |

| Wales | 2,000,000 |

Planning approval totals by region:

| Region | Value (£) |

|---|---|

| Scotland | 593,000,000 |

| South East | 590,000,000 |

| East of England | 158,000,000 |

| Yorks & Humber | 150,000,000 |

| South West | 111,000,000 |

| East Midlands | 100,000,000 |

| Wales | 97,000,000 |

| West Midlands | 85,000,000 |

| Republic of Ireland | 73,000,000 |

| North East | 67,000,000 |

| North West | 58,000,000 |

| London | 12,000,000 |

| Northern Ireland | 1,000,000 |

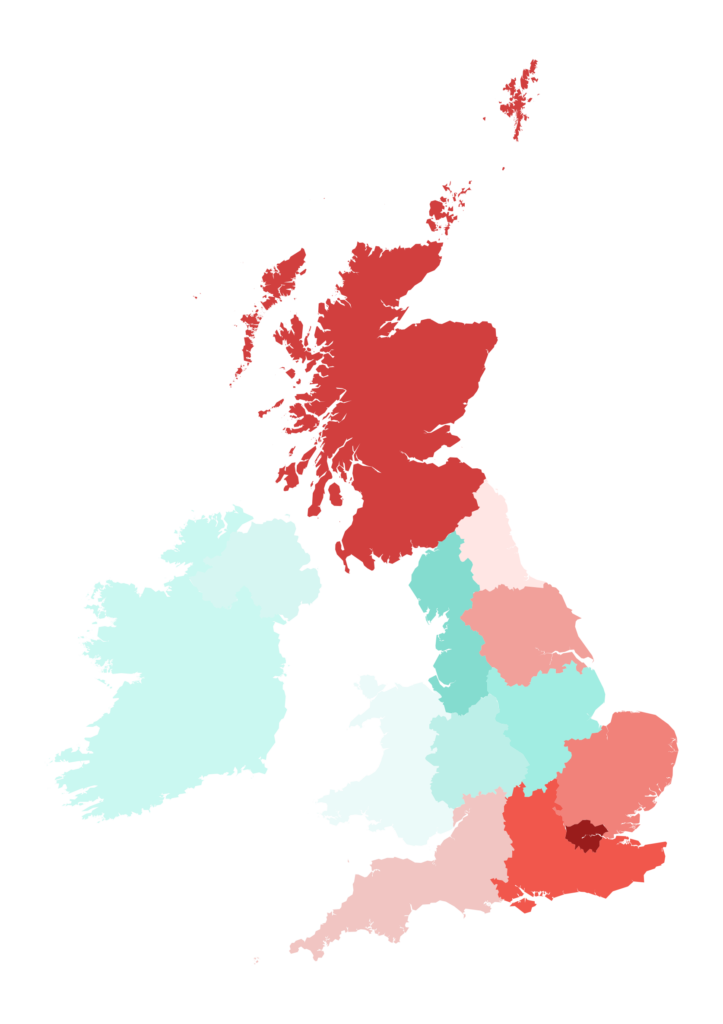

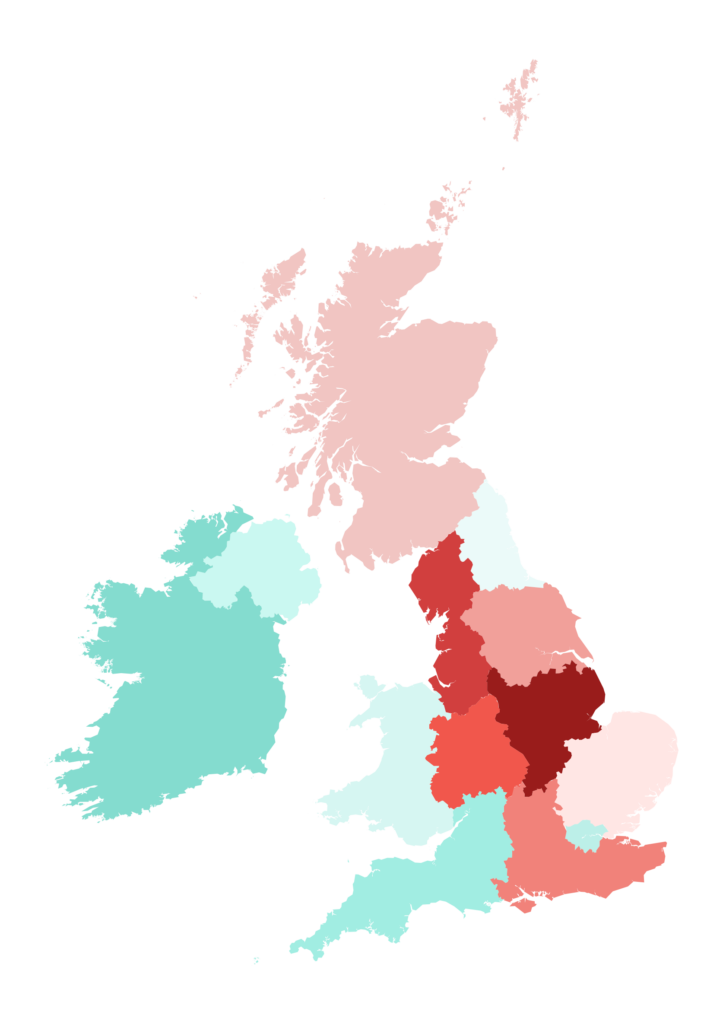

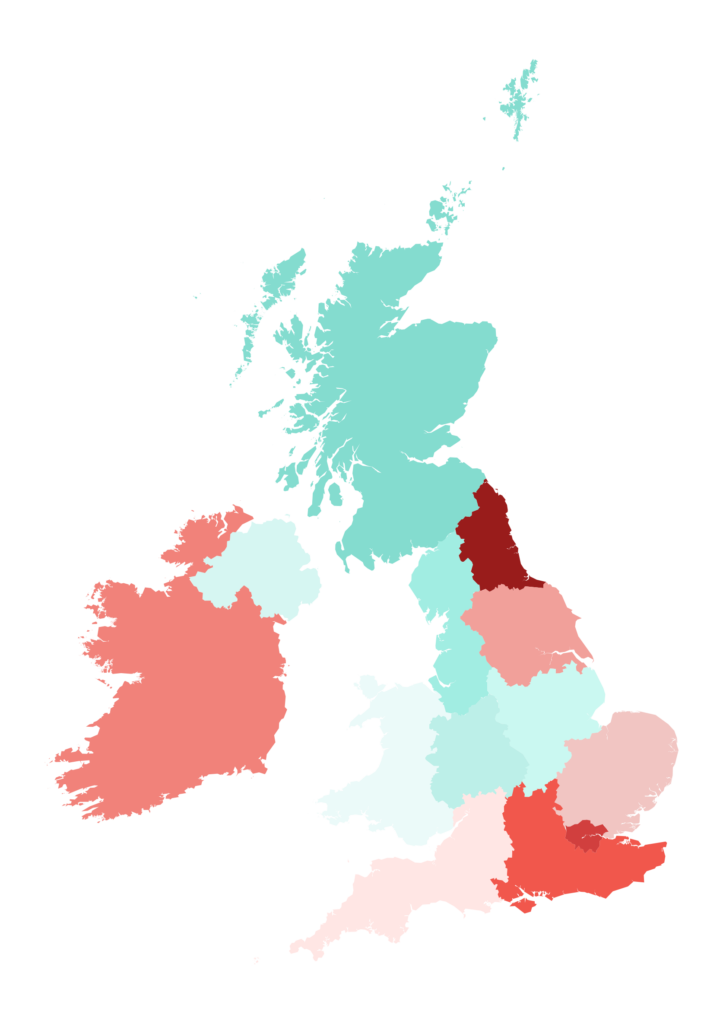

Industrial

With this sector encompassing a wide array of major works, the opportunity for connections is vast and features figures across a distinct scope of industries.

In recent times we have seen the warehouse subsector boom, at least in part down to the move for retail to online shopping, seeing major retailers move from city centre storefronts to large out-of-town distribution centres. Tracking the key players in this industry could be a vital factor for those wanting to find success in the Industrial sector.

There are huge opportunities to connect with large developers and major contractors in industries as varied as food production, scientific/research and development fields, agriculture, chemicals, retail, and many more.

Contract award totals by region:

| Region | Value (£) |

|---|---|

| East Midlands | 136,000,000 |

| Yorks & Humber | 112,000,000 |

| East of England | 111,000,000 |

| West Midlands | 111,000,000 |

| North West | 70,000,000 |

| South East | 59,000,000 |

| Wales | 47,000,000 |

| London | 46,000,000 |

| Republic of Ireland | 31,000,000 |

| South West | 29,000,000 |

| Scotland | 21,000,000 |

| North East | 11,000,000 |

Planning approval totals by region:

| Region | Value (£) |

|---|---|

| East Midlands | 222,000,000 |

| North West | 183,000,000 |

| West Midlands | 136,000,000 |

| South East | 94,000,000 |

| Yorks & Humber | 93,000,000 |

| Scotland | 77,000,000 |

| East of England | 74,000,000 |

| Republic of Ireland | 49,000,000 |

| South West | 31,000,000 |

| London | 26,000,000 |

| Northern Ireland | 5,000,000 |

| Wales | 5,000,000 |

| North East | 5,000,000 |

Education

The Education sector stretches further than the traditional state schools that may be typically thought of when considering this sector.

Nurseries, private schools, colleges, universities, special requirement schools, and training centres are all part of this permanently important sector.

Whilst its monthly figures may not be as consistently high as some other sectors, the vital need for education to continue to improve should ensure that projects are always in play. With Barbour ABI you can find contact details of the key players of every education project in the regions that you want to target.

Contract award totals by region:

| Region | Value (£) |

|---|---|

| East of England | 70,000,000 |

| North West | 65,000,000 |

| London | 62,000,000 |

| Scotland | 60,000,000 |

| South East | 56,000,000 |

| East Midlands | 48,000,000 |

| Republic of Ireland | 44,000,000 |

| Wales | 35,000,000 |

| Yorks & Humber | 28,000,000 |

| North East | 21,000,000 |

| West Midlands | 21,000,000 |

| South West | 7,000,000 |

Planning approval totals by region:

| Region | Value (£) |

|---|---|

| Scotland | 152,000,000 |

| South East | 115,000,000 |

| London | 48,000,000 |

| West Midlands | 44,000,000 |

| East of England | 37,000,000 |

| Yorks & Humber | 35,000,000 |

| Wales | 34,000,000 |

| Republic of Ireland | 33,000,000 |

| East Midlands | 28,000,000 |

| South West | 28,000,000 |

| North West | 23,000,000 |

| North East | 3,000,000 |

| Northern Ireland | 2,000,000 |

Hotel, Leisure & Sport

The Hotel, Leisure and Sport sector features exactly what it says on the tin. Hotels, motels, pubs, and restaurants frequently dominate the sector. Whilst leisure centres, arenas, stadia, and exhibition centres are the drivers of success in the leisure and sport subsectors.

With such a variety of activity in the Hotel, Leisure & Sport sector, there are opportunities for you to target key figures from private hotel chains of all sizes, local councils, sports teams & leagues, major events businesses and many more fields.

Contract award totals by region:

| Region | Value (£) |

|---|---|

| West Midlands | 106,000,000 |

| Scotland | 82,000,000 |

| Republic of Ireland | 42,000,000 |

| South East | 34,000,000 |

| Wales | 29,000,000 |

| East of England | 13,000,000 |

| Yorks & Humber | 13,000,000 |

| South West | 9,000,000 |

| London | 7,000,000 |

| North West | 5,000,000 |

| East Midlands | 3,000,000 |

| North East | 1,000,000 |

Planning approval totals by region:

| Region | Value (£) |

|---|---|

| North East | 215,000,000 |

| London | 159,000,000 |

| South East | 128,000,000 |

| Republic of Ireland | 110,000,000 |

| Yorks & Humber | 92,000,000 |

| East of England | 63,000,000 |

| South West | 34,000,000 |

| Scotland | 30,000,000 |

| North West | 22,000,000 |

| West Midlands | 17,000,000 |

| East Midlands | 14,000,000 |

| Northern Ireland | 12,000,000 |

| Wales | 5,000,000 |

Medical & Healthcare

With a Labour government taking power in 2024, there may be a greater focus on the Healthcare sector in the coming years. Government schemes to build or refurbish a number of hospitals before 2039 will also have a major impact on the opportunities available in the sector.

The opportunities in medical and healthcare include: public and private hospitals, secure facilities, surgeries, health and medical centres, hospices, nursing homes, veterinary services, and more. NHS Trusts, local governments and private healthcare providers are the clients most consistently involved in medical and healthcare projects that you should aim to follow and target if you are looking to grow within this sector

Contract award totals by region:

| Region | Value (£) |

|---|---|

| East of England | 72,000,000 |

| North East | 41,000,000 |

| London | 10,000,000 |

| South West | 10,000,000 |

| South East | 9,000,000 |

| East Midlands | 7,000,000 |

| Republic of Ireland | 7,000,000 |

| North West | 4,000,000 |

| Yorks & Humber | 3,000,000 |

| Scotland | 2,000,000 |

| West Midlands | 2,000,000 |

| Wales | 1,000,000 |

Planning approval totals by region:

| Region | Value (£) |

|---|---|

| East Midlands | 34,000,000 |

| South East | 26,000,000 |

| East of England | 18,000,000 |

| Republic of Ireland | 16,000,000 |

| North East | 16,000,000 |

| Scotland | 7,000,000 |

| West Midlands | 5,000,000 |

| North West | 3,000,000 |

| Northern Ireland | 2,000,000 |

| Yorks & Humber | 2,000,000 |

| London | 2,000,000 |

| Wales | 1,000,000 |

| South West | 1,000,000 |

Want to be notified when the latest data is available?

Jump to:

Get monthly issues sent straight to your inbox

Need a previous version of Sector Review?

Our monthly review highlights the top-performing sectors by region, giving you the latest insights into UK construction trends. If you need historical data or access to older reports, our team is here to help – just get in touch and let us know what you’re looking for.

Free Construction Industry Insight Reports

Barbour ABI provides construction industry insights and intelligence. Head to our Construction Market Analysis Report pages to get even more free construction insights sent straight to your inbox every month.